Angola's OPEC Journey: A Brief Overview

Angola, a member since 2007, has made the unprecedented decision to exit OPEC, citing a misalignment of interests. With a daily oil production of 1.1 million barrels, Angola’s departure from OPEC underscores its determination to take control of its oil policies to meet domestic economic priorities.

In a groundbreaking move, Angola has officially withdrawn from the Organization of the signaling a seismic shift in the intricate web of global oil dynamics. In this SEO-friendly blog post, we will explore the reasons behind Angola’s decision, its immediate impact on oil prices, and the potential ramifications for Angola’s departure from OPEC and the broader energy landscape.

Angola, a member since 2007, has made the unprecedented decision to exit OPEC, citing a misalignment of interests. With a daily oil production of 1.1 million barrels, Angola’s departure from OPEC underscores its determination to take control of its oil policies to meet domestic economic priorities.

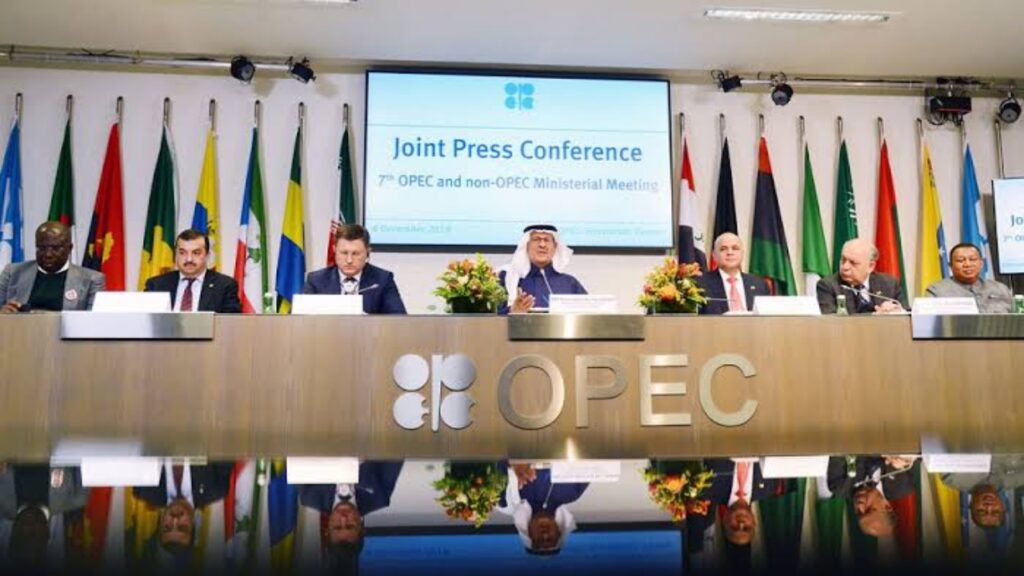

In a groundbreaking move, Angola has officially withdrawn from the Organization of the Petroleum Exporting Countries (OPEC), signaling a seismic shift in the intricate web of global oil dynamics. In this SEO-friendly blog post, we will explore the reasons behind Angola’s decision, its immediate impact on oil prices, and the potential ramifications for Angola’s departure from OPEC and the broader energy landscape.

Minister Diamantino Azevedo’s announcement hinted at disagreements over production quotas, specifically objecting to OPEC’s decision to cut Angola’s production quota for 2024. While details remain scant, Angola’s move reflects a growing trend of nations reevaluating their OPEC membership in pursuit of autonomous economic strategies.

Global Oil Prices React: Brent Takes a Hit

The news of Angola’s exit sent shockwaves through global oil markets, with Brent prices dropping over $1 to $78.50 a barrel. This sharp decline underscores the market’s sensitivity to thrive in this ever-evolving industry geopolitical changes and reveals the challenges OPEC faces in maintaining stability amidst member dissent.

Embark on a journey through Angola’s departure from OPEC exit with our in-depth analysis, decoding seismic shifts in the global oil market. Navigating these changes requires strategic SEO insights as we unravel and give price fluctuations and market trends. Stay ahead in the oil game with our catchy yet informative analysis, providing a roadmap for success. From understanding the nuances of to adapting to the dynamic #GlobalOilMarket, our concise exploration ensures

OPEC's Setback and Intra-Member Challenges

Angola’s departure presents a setback for OPEC, already navigating internal dissent. The organization must now address challenges in maintaining unity and cohesion as member nations, Angola’s departure from OPEC driven by differing national interests, reassess their roles and contributions.

Economic Considerations: Angola's Quest for Autonomy

For Angola, heavily reliant on oil revenues, the decision to leave OPEC is likely rooted in economic considerations. By asserting control over its oil production policies, Angola aims to align them with its economic objectives and domestic priorities.

Implications for OPEC+ Collaborative Efforts

The OPEC+ alliance, crucial for stabilizing oil markets, now faces uncertainties with Angola’s departure. The collaborative framework may undergo shifts as member nations reassess their roles, potentially affecting the group’s ability to implement cohesive production strategies.

As Angola charts a new course, the global oil market must adapt to the evolving dynamics shaped by OPEC’s changing landscape. The coming months will reveal the impact of Angola’s decision on not only its economic trajectory but also the broader geopolitical and economic canvas influenced by OPEC’s role in the global energy arena.

Geopolitical Dimensions: Beyond Economics

Angola’s exit may not be solely economic. It could be a strategic geopolitical move to assert sovereignty and pursue foreign policy objectives independently of OPEC’s collective decisions, adding a layer of complexity to global energy politics.

Conclusion: Unraveling the Tapestry

In conclusion, Angola’s exit from OPEC has far-reaching implications for the global oil industry. The nuanced reasons behind this decision, coupled with its immediate impact on oil prices, set the stage for a period of adjustment and recalibration within OPEC and its collaborative efforts. As the world watches how this narrative unfolds, the complexities of geopolitics, economics, and energy diplomacy intertwine to shape the future trajectory of global oil dynamics. Stay tuned for updates as we delve deeper into the unfolding story of Angola’s exit from OPEC and its reverberations across the global oil stage.